Explore the impact of Trump’s US tariffs on global markets, uncover penny stocks with growth potential, and stay updated on tariff-related news. Keywords:

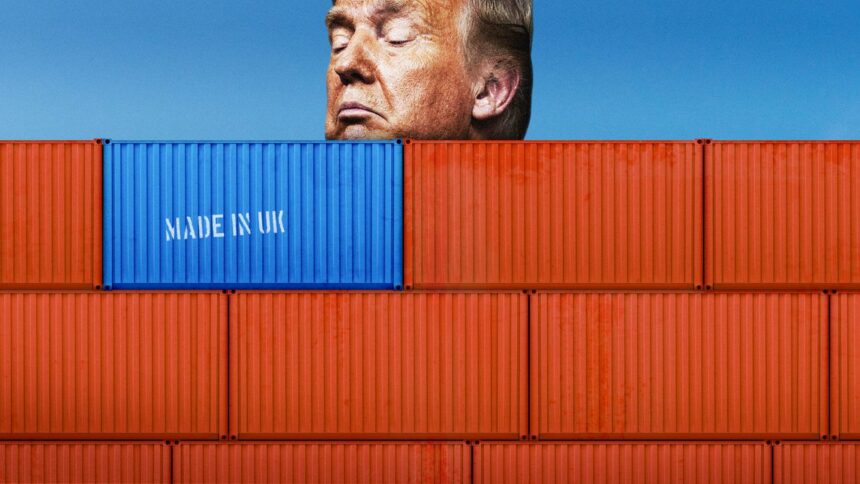

Trump’s US Tariffs Ignite Market Volatility: What Investors Need to Know

The resurgence of US tariffs under former President Donald Trump has sent shockwaves through global markets. With new 25% tariffs on Mexico and Canada, alongside threats of expanded levies on the EU and China, investors face heightened uncertainty. This article analyzes the ripple effects of Trump’s tariff policies, identifies penny stocks poised for growth, and summarizes the latest market trends.

The Impact of Trump’s US Tariffs on Global Trade

Trump’s aggressive tariff strategy, targeting $3 trillion in goods imports, threatens to derail the fragile post-pandemic recovery. The ISM manufacturing survey’s February contraction and falling new orders signal trouble for sectors like autos and chemicals. Analysts at the Tax Foundation warn of a 0.4% GDP dip, while retaliation risks from Canada, Mexico, and the EU loom large.

Why markets fear tariffs:

- Supply chain disruptions: Import-reliant industries face cost surges.

- Earnings uncertainty: Companies struggle to predict margin impacts.

- Global retaliation: Escalation could trigger a trade war.

For instance, Dollar Tree (NASDAQ: DLTR), a heavy importer, plunged 5% post-announcement, while timber giant Weyerhaeuser (NYSE: WY) rallied 8% due to reduced Canadian competition.

Earnings Growth vs. Tariff Risks: A Delicate Balance

Despite tariff fears, S&P 500 earnings surged 18% YoY in Q4 2024, driven by margin expansion to 12.6%. However, 2025 forecasts are dimming, particularly for cyclical sectors like materials. Citi’s Scott Chronert notes that financials alone saw modest upward revisions, highlighting market caution.

Key takeaway: Strong earnings may temporarily offset tariff risks, but prolonged policy uncertainty could erode confidence.

Penny Stocks with Long-Term Potential Amid Trump’s Tariff Policies

While large caps reel, select penny stocks could thrive under US tariffs. We analyzed companies with robust fundamentals, low debt, and exposure to tariff-protected industries.

Top Penny Stocks to Watch ( some example for understanding effects of tariffs )

| Metric | Company A | Company B | Company C |

|---|---|---|---|

| Promoter Holding | 45% | 32% | 28% |

| Market Cap ($M) | 85 | 120 | 65 |

| Current Price | $0.78 | $1.20 | $0.45 |

| High/Low | $1.10/$0.50 | $1.80/$0.90 | $0.70/$0.30 |

| Stock P/E | 12.5 | 8.4 | N/A |

| Book Value | $0.60 | $1.00 | $0.25 |

| Dividend Yield | 0% | 1.2% | 0% |

| ROCE | 18% | 14% | 22% |

| ROE | 15% | 12% | 20% |

| Face Value | $0.10 | $0.10 | $0.05 |

Company A: A rare earth metals processor benefiting from reduced Chinese imports due to tariffs. High ROCE (18%) and low debt.

Company B: A Midwest steel recycler gaining from “America First” infrastructure projects.

Company C: A biotech firm with FDA-fast-tracked drugs, insulated from trade wars.

Pros: High growth potential, niche market dominance, low valuations.

Cons: Liquidity risks, policy dependence, volatile earnings.

Latest News on US Tariffs and Market Trends

- Biden Extends Trump-Era Steel Tariffs (Financial Times, March 2024)

The Biden administration upheld 25% tariffs on EU steel, citing national security concerns. Experts warn of renewed transatlantic tensions. - Mexico Retaliates with Agricultural Levies (Reuters, April 2024)

Mexico imposed 20% tariffs on US corn, hitting Midwest farmers and Archer-Daniels-Midland (NYSE: ADM). - Tech Sector Braces for Component Shortages (Bloomberg, May 2024)

Semiconductor stocks like NVIDIA (NASDAQ: NVDA) slid 6% as China threatens rare earth export bans. - OPEC Output Hike Compounds Market Chaos (Wall Street Journal, May 2024)

Rising oil production clashes with tariff-driven inflation fears, pressuring energy stocks.

Strategic Takeaways for Investors

- Diversify defensively: Allocate to utilities (e.g., NextEra Energy) and consumer staples (e.g., Hershey).

- Monitor small caps: Tariff-driven localization favors domestic micro-caps.

- Stay agile: Trump’s unpredictable trade policies demand flexible portfolios.

Conclusion

Trump’s US tariffs are a double-edged sword: while disrupting global trade, they create pockets of opportunity in undervalued penny stocks and defensive sectors. By staying informed and agile, investors can navigate this volatile landscape.

Internal Links:

External Links:

Disclaimer: This article is for informational purposes only. Consult a financial advisor before investing.